Your support will forever change the trajectory of those in our community who do not have access to healthcare. Those who are uninsured or underinsured count on Mission of Mercy to be there stable medical home, providing compassionate, comprehensive, primary healthcare … no questions asked.

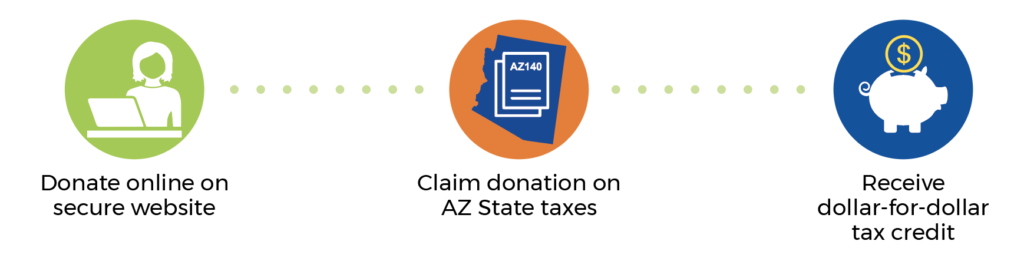

The Arizona Qualified Charity Tax Credit has been created for individuals who submit Arizona income tax returns. The tax credit applies to cash donations made to qualified nonprofit organizations, like Mission of Mercy AZ Health Partnership Fund, that provide assistance to low-income Arizona residents and vulnerable families.

Write a check payable to:

Mission of Mercy Arizona Health Partnership Fund

360 E Coronado Road, Ste 160

Phoenix, AZ 85004

All clinic locations are open on designated days from 9am to 4pm . Click Here for appointment information.